Get information on the most common account tasks.

Log in to your account from any computer, tablet or mobile device. Complete the quick and easy registration process to get access to the most important account features.

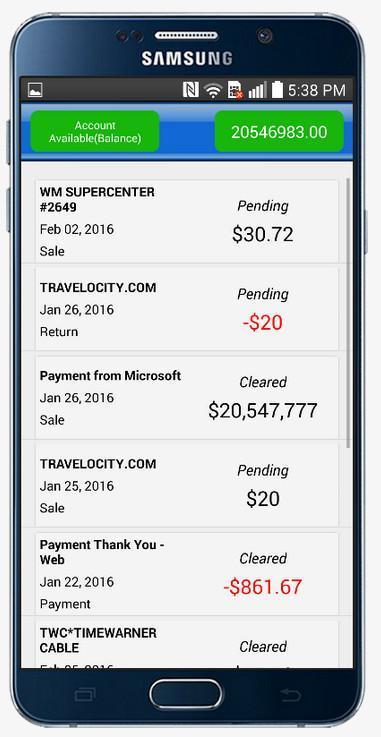

777 bank account. Write a application for refund of debited money from bank? Lost my money on 28/03 thr misuse of my debit card.it was the bank who called reg the same n blocked my card.complaint with commisioner of police? 777 bank accounts.

- Nov 25, 2010 777 Discount Club Takes money out of bank account unauthorized Scottsdale, Arizona.EDitor's Suggestions on how to get your money back into your bank account that someone wrongfully takes it from you!.Consumer Comment: me 2.

- May 20, 2016 However on the third day I received an email stating the money had been returned to my bank roll and my account blocked. I received a further email stating that 'This is the Operations Team at 777 and we are contacting you with regards to your account with username 'coldeyes616'.

- Learn about banking options 777 offers and play great casino games at 777! 888 UK Limited is licensed and regulated in Great Britain by the Gambling Commission under the account.

Log in/Register

Apply for a new loan using our mortgage access center or sign up to manage your existing mortgage.

Manage My LoanManage My ApplicationMaking Payments

Hassle-free ways to make your loan payments any time.

Mortgage Relief and Disaster Assistance

Life happens. Whether you’ve lost a job or endured a natural disaster, we’re here to help.

Paperless Statements

Manage your mortgage with text or email notifications and 24/7 access to everything online.

Your New Loan with PennyMac

View your account online, make payments, and more.

Tax and Insurance Information

Everything you need to know about taxes and insurance.

Apply Online

Start your application with our mortgage access center (m.a.c).

Accessing Loan Information Online

Whenever you want, wherever you are, your loan information is here. Visit www.PennyMacUSA.com or Download PennyMac Mobile and log in to access your account. Not registered? Sign up to get immediate access to your mortgage account from any computer, tablet or mobile device.

Browse through our secure website features that include:

- Make a Payment

- Manage PennyMac Auto Pay Plan

- Manage Pending Payments

- View Statements and Documents

- Sign Up for Paperless Statements

- Loan Activity

- Amortization Calculator

- Message Center

- View Escrow Information

- Update email address

- Update mailing address

Accessing Account Information By Phone

Our automated phone system is available 24 hours a day, 7 days a week. It allows you access to the following services:

- Pay-by-Phone (a fee may be charged for this service in accordance with the laws of your state)

- Payment and correspondence address information

- Account information including loan balance, last payment received, next payment due, and payment amount

- Tax and insurance information

- Year-end tax and insurance information

Impacted by a natural disaster?

If a natural disaster, accident or other event has damaged your home or created a financial hardship, we are here to help.

Customer Service

Contact our customer service team with any inquiries. Our Customer Service Representatives are available Monday - Friday, 6 a.m. to 6 p.m. PT and Saturday, 7 a.m. to 11 a.m. PT (800) 777-4001

BE AWARE OF FORECLOSURE & LOAN SCAMS!

- PennyMac does not charge fees for a modification or other loss mitigation plans when you are facing a delinquency

- PennyMac does not accept payments from Money Gram

- Funds are always payable to PennyMac and not to an individual

PennyMac will work with you to ensure every option possible is explored to retain home ownership. No fees. No strings.

Results

FIRST YEAR: Instead of having ZERO cash value with a normal whole life insurance policy, this person will have $31,246! So what happened with the other $8,754? The life insurance company is taking a big risk – if that person dies, they need to pay $960k in Death Benefit (permanent – not term). And of course, some of the $8,754 will be the commission that the agent will make. That is WAY different from having ZERO cash value, and the agent making $30,000+ for commission.

SECOND YEAR: The cash value will grow to $67,440 – versus zero cash value with a normal whole life insurance policy. This year, the policy will just use $3,806 to keep the death benefit of $960k.

THIRD YEAR: The cash value will grow to $110,291. How much of the premium went to the cash value now? Practically all of it! Compare that versus a normal life insurance policy where you will still have zero cash value in the third year.

FOURTH YEAR: The cash value will grow to $156,262. And how much was the client total premium at this point? $160k. This person – in just 4.5 years – recaptured all premiums paid, but she still has a death benefit of $960k. We could say that the death benefit didn’t cost her anything at this point.

FIFTH YEAR: The cash value will grow to $205,337 (more than the Cum. Premium Outlay). So what is the rate of return this person is getting? About 6.3% tax-free!! The equivalent would be to find a savings account that will pay 8.7% (with a 28% tax bracket) – with no risk, completely secure, not tied to the stock market, credit protected and completely liquid. Oh, and the client will get a death benefit on the side as a bonus.

Now, each client is different, so the results could be more or less favorable. In this particular example, the client is still young (so the death benefit is still cheap), and she is paying a decent premium of $40,000. If a client is older and/or paying a much lower premium, then the “break even” point could be 5-8 years. On average, my clients break even in just 5 years.

In this example, I am using the current dividend scale for 2016. The company can, and will, change dividends every year depending on many factors, but this mostly depends on their investment results. Mutual life insurance companies DO NOT depend on the stock market, but invest in things like mortgages (not sub-prime), treasury bonds, corporate bonds, joint ventures, etc. Right now, interest rates are very low, so the dividends that they are paying are also low. For example, in the 80’s life insurance companies were paying almost double than what they are paying right now. It is my personal opinion that interest rates will go up in the next few years, so mutual life insurance companies will be able to pay a better dividend, and the results will be more favorable than what I am illustrating. So for these illustrations, I used a very low dividend scale. And finally, these companies have paid dividends for more than 100 years without missing one year - even through the Great Depression. They have stood strong through some of the most difficult times in history, which is the reason why this strategy has been used by wealthy Americans, big banks and large corporations for centuries.

777 Bank Account Sign In

Last Remarks

While not everyone is in the right situation to take advantage of this strategy, I truly believe it is the best place to build a strong financial foundation. It is unparalleled in the benefits that it offers, and it gives you complete and total control.

I personally found sincere satisfaction in putting these strategies into practice for me and my family.

Thank you for taking the time to read this blog. I hope this information will be as beneficial for you as it has been to me.

If you think this may be something beneficial for you and your family, feel free to reach us at info@hesedfinancial.com or call us at (855) 702-7702.

God bless you!

Sincerely,

Edgar I. Arceo

The Hesed Financial Group

2002 Timberloch Pl, Suite #202

The Woodlands, TX 77380